Bitcoin Has Hit $19,000. Whats Next?

Have you heard the news?

Bitcoin broke $19,000.

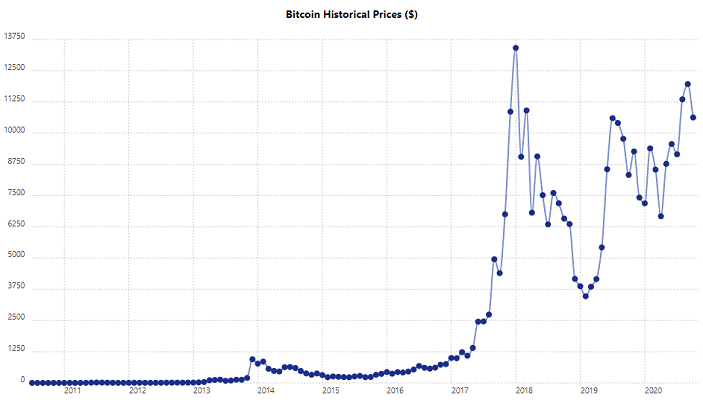

This is not the first time that this has happened. Bitcoin broke $19,000 in early 2018 before crashing after a few days.

This time looks a little different – the price of Bitcoin has stayed at or around $19,000 for a few weeks.

It looks much, much better than last time.

Anyway, this article will explore the possibilities for Bitcoin after breaking $19,000 per coin.

How long will it last?

The first, and probably most important, question is how long will Bitcoin’s price stay above $19,000.

So far, Bitcoin has stayed above $19,000 for longer than any other point in history, which is a great sign for the future of the coin.

Additionally, Bitcoin tends to have a price increase during the holiday season. The exact reason is obviously unknown, but most believe it is due to increased investment from retail investors due to the holiday season.

Perhaps people buy Bitcoin for friends and family as a Christmas present?

The reason is not too important. All that matters is the trend – and the trend shows that Bitcoin will likely stay above $19,000 through the end of 2020.

$20,000 Is The Price

Bitcoin made waves, again, for breaking it’s previous all time high of around $19,800.

That is great news. However, $19,800 is not the number that Bitcoin needs to exceed for long term success.

Bitcoin must break $20,000.

Why does Bitcoin need to break $20,000?

It’s simple – $20,000 is a huge psychological barrier because humans like round numbers that are multiples of 5 and 10.

We know, it’s weird, but that’s how it works.

This is evidenced by many in the cryptocurrency community awaiting the price of Bitcoin to reach $20,000. Memes have been created, people are talking, and the world is awaiting $20,000.

Quite frankly, no one really cared about breaking the all-time high. Those that did seem to care only cared because $19,800 is very close to $20,000.

With that in mind, $20,000 is the price that Bitcoin needs to hit before the bull market will officially begin.

What do the experts say?

It’s good to get an expert opinion on the future price of Bitcoin. Granted, the experts know about the same as the average user, but it’s still nice to read what others have to say.

Well, the experts are very bullish on Bitcoin.

The price predictions have ranged from Anthony Pompliano’s $100,000 bitcoin price by the end of the year to the Winklevoss twins recently stating that Bitcoin will reach $500,000 per coin in the next 10 years.

The Winklevoss twins also predict that the market cap of Bitcoin will exceed that of gold. Gold has a $9 trillion USD market cap.

That is a bold prediction from the Winklevoss twins. However, the twins have possession of two billion dollars worth of Bitcoin.

It might be wise to listen to their price prediction on Bitcoin.

As for negative predictions about Bitcoin, there don’t seem to be any. It’s difficult to find someone claiming that Bitcoin is dead as was common in 2017.

What is causing Bitcoin’s price to rise?

Bitcoin’s rise in price baffles the experts. There is no consensus on what is causing the rise in price of Bitcoin like there was in 2017 during the ICO boom.

However, there are a handful of theories for the rise in price. The likely scenario is that all these factors have played a part in the rise of Bitcoin. Here are some of the theories:

Decentralized Finance is Booming

Decentralized finance, often referred to as DeFi, is the replacement of the traditional financial system with a decentralized model that relies on the blockchain.

Basically, the white papers of many ICOs from 2017 are finally coming to fruition with DeFi in 2020.

Now, there is no denying that DeFi is driving some of the price increases in cryptocurrency. This is apparent by the price increase in Ether, Chainlink, Stellar, and the emergence of Polkadot.

All those projects have a heavy focus on DeFi – either as a foundation for DeFi or as a DeFi project itself.

What is less apparent is how much impact DeFi projects have on the price of Bitcoin.

The general consensus appears that many people purchase Bitcoin in order to invest in a DeFi project, which is quite similar to Bitcoin and Ether being used to invest in ICOs in 2017.

We rank DeFi as a major contributing factor to the price increase of Bitcoin.

Tether is Pumping the Market, Again

Another factor that cannot be ignored in the rise of Bitcoin is the role that Tether plays in Bitcoin price increases.

For those that do not know, Tether has been accused of minting more of its stablecoin – Tether coin – in order to purchase Bitcoin and drive up the price.

In other words, some allege that Tether was responsible for the rise of Bitcoin in 2017.

It might sound crazy, but Tether has never actually been audited and has admitted that they are not 1:1 backed by fiat currency. In fact, Tether no longer claims to be 1:1 backed by fiat currency due to pressure from the US federal government.

As for what we think, there is seemingly something to the Tether story. However, the impact that Tether has on the price of Bitcoin remains to be seen and the exact amount of money that Tether mints is unknown.

It is still important, in our opinion, to pay attention to when Tether mints millions of dollars worth of USDT and sends it to Bitfinex or Binance. It may or may not indicate fraud, but it certainly indicates that the price of cryptocurrency will increase.

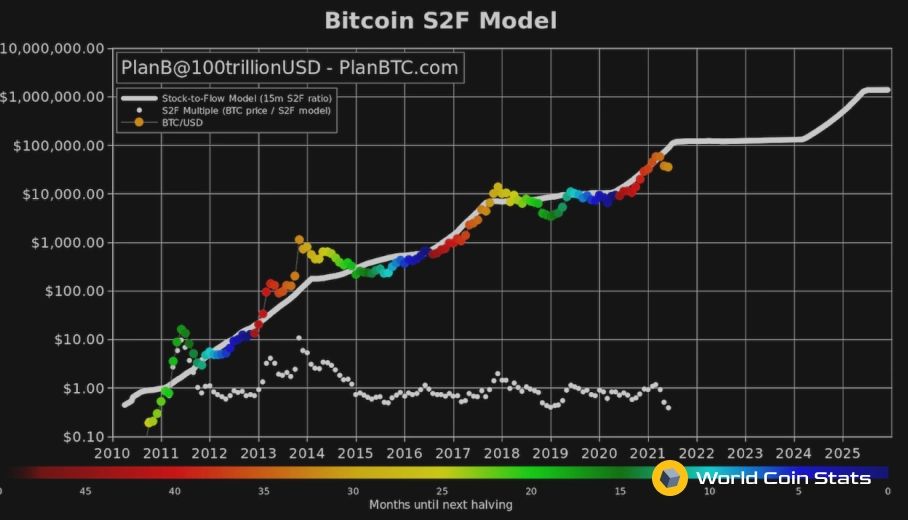

It’s All Cyclical

An emerging theory about the price rise of Bitcoin is that it is entirely cyclical.

That’s right, the price of Bitcoin seems to operate in 3 year bear markets followed by a short bull market.

Have we entered a bull market?

It appears that way. And the timeline also fits this model.

Media Hype

Finally, some in the cryptocurrency community believe that the price increase of Bitcoin is mostly due to media hype.

That’s a good theory for later price increases, but it does have one problem.

The price of Bitcoin increases before the media brings attention to it. The media only reports on Bitcoin price increases after they occur.

Despite that problem, this is a good theory. It’s undeniable that the media amplifies any Bitcoin price increase.

Just think, how many people had completely forgotten about Bitcoin until the media started running stories about Bitcoin breaking its all-time high?

A lot of people. And many of those people likely bought some Bitcoin when they heard that news.

Institutional Investors

The final potential factor driving Bitcoin’s price are institutional investors. It’s no secret that Bitcoin has become more mainstream on Wall Street. Grayscale Bitcoin Trust allows those on Wall Street to trade Bitcoin in a manner similar to normal stock trading.

Unfortunately, Bitcoin ETFs are still currently banned in the United States, but keep an eye out for legislation allowing a Bitcoin ETF – the price of Bitcoin will skyrocket when, not if, that occurs.

Will 2021 be a big year for Bitcoin?

Obviously, no one knows the future price of Bitcoin. We can only offer predictions based on previous trends and evidence.

However, it does appear that 2021 is lining up to be a huge year in Bitcoin. The experts are on the news claiming that Bitcoin will rise to six figures in 2021, DeFi is taking Bitcoin by storm, and Tether has a market cap of nearly $20 billion USD.

Everything is pointing towards Bitcoin having a massive 2021.

Is it a good time to invest in Bitcoin?

Yes. It’s always a great time to invest in Bitcoin.

We are of the belief that Bitcoin will always exceed its all-time high on a long enough timeline.

Sure, that might take three years, but you will eventually turn a profit.

The same cannot be said about other “safe” investments outside of gold and real estate, which are both much less accessible than Bitcoin.

As a short or medium term investment, Bitcoin looks great. All the fuel is there (DeFi, retail interest, investment interest) for a tremendous rise in price over the next year.

How should I invest in Bitcoin?

If you have a large amount of money to invest in Bitcoin, then you are better off using the dollar cost average (DCA) method of investment.

This means you invest a percentage of the total that you plan on investing in Bitcoin over a period of a few months or weeks. DCA eliminates a lot of the variance with the price and you do not have to worry about “timing” the market.

As the saying goes, timing the market is the same as catching a falling knife.

Of course, you can also just invest all your money at one time, but you might pay a higher price doing it that way.

Really, this just comes down to your risk tolerance. If you can tolerate high risk, then invest as a lump sum.

If you have a lower risk tolerance, then DCA your position into Bitcoin.

What other cryptocurrencies will increase in price?

Generally, all cryptocurrencies increase in price when Bitcoin rises. This time around it looks like the bull market will revolve around DeFi tokens, so we recommend keeping an eye on any cryptocurrencies that are vital to the success of DeFi.

Some of those cryptocurrencies include the following.

- Polkadot

- LINK

- Ethereum

You can’t go wrong with any of those cryptocurrencies if you want some exposure to DeFi. LINK and Polkadot both have a stronger focus on DeFi than Ethereum, though.

LINK and Polkadot are also much newer than Ethereum.

Final Verdict

That covers it for our prediction on Bitcoin and the next chapter in the Bitcoin story.

With the current price trends, it really does look like Bitcoin will make a leap to and above the $20,000 price support sometime in 2021 or even 2020.

And once that happens, the sky’s the limit when it comes to the price of Bitcoin – it will not drop for a long time after hitting that price. As always, we think it’s a great time to buy Bitcoin – the price always bounces back stronger than before.

Quite frankly, we’re on the cusp of a major increase to the price of Bitcoin. Also, other cryptocurrencies such as Polkadot, LINK, and Ethereum would all make good investments at this moment.