IC Markets Review 2019

With the hype around the world’s largest ECN Forex Broker, there is no wonder why we would do an IC Markets review. Did you know that IC Markets is the largest Forex CFD provider by Forex volume? Not only this, but the company gives access to the most popular and liquid markets across the world. By doing so, IC Markets guarantees excellent trading opportunities. As they have carefully selected a range of products, it would be hard not to check what this company has to offer. So, if you want to learn more about the opportunities, IC Markets offers, keep on reading this review.

IC Markets

Trading Volume: March 2019 – US$646 Billion

Active Clients Worldwide: 0ver 60,000

Rating on Trustpilot: Excellent 9/10

IC Markets is an Australian Forex and CFDs Broker. Moreover, the company is thriving since it first opened doors in 2007. Also, as IC Markets was founded by traders, it is understandable why they offer great opportunities. Throughout the years, International Capital Markets Pty Ltd. has shown great dedication in offering superior spreads, execution, and service. Moreover, if you are a trader who likes features like scalping, hedging, and automated trading, IC Markets won’t disappoint you.

In fact, International Capital Markets Pty Ltd. is the perfect place for automated traders. The company has an order matching engine in the New York Equinix NY4 data center. Also, the engine processes over 500,000 trades per day. And two-thirds of all trades come from automated trading systems. Moreover, the other IC Markets trade server is in LD5 data centers in London. There the company utilizes enterprise-grade hardware. Also, as the goal of IC Markets is to provide ultra-low latency price feeds, traders all around the world can reap these benefits.

Currently, the mission of this company is to help traders focus more on their trading. However, to do so, they need the right tools. One of which is the ultra-fast order execution. Currently, the average execution speeds of under 40ms. How do low latency fiber optic and Equinix NY4 server sound to you? If you don’t know what we are talking about, keep on reading.

More About IC Markets

Regulations: ASIC

Type: Market Maker, ECN, STP

Leverage: 1:500

Minimum Deposit: $200

Pip Spreads: 0.0

Micro Lot Trading: 0.01

Tradable Instruments: 232

Let’s begin with the spreads. Currently, IC Markets EURUSD average spread of 0.1 pips is the best in the world. Indeed, the company offers the tightest spreads out of all forex brokers around the globe with a EURUSD spread averaging just 0.1 pips. Moreover, Raw spreads could go to 0.0 pips.

As IC Markets has over 25 liquidity providers, they offer market-leading spreads in each of the platforms. The company has indeed established strong relationships with other major liquidity providers in the industry. For example, they partner with Meta Trader 4, Meta Trader 5 and cTrader, which gives them the advantage of offering variable spreads on these forex trading platforms.

Currently, Tradable Instruments on IC Markets are as following:

- Forex Market: 60 products

- Commodities: 19 products

- Stocks: 120 products

- Indices: 17 products

- Bonds: 5 products

Platforms

- MT4

- MT5

- MT WebTrader

- cTrader

As we said previously, IC Markets was built by traders. As such, the company’s mission is to create the best trading experience for retail and institutional clients. Currently, the Forex and CFDs broker offers access to around two hundred and thirty tradeable instruments. Also, the average spread is 0.1 pips, and the flexible leverage options provide up to 1:500. Meanwhile, deposits are accepted in 10 major currencies. When using IC Markets, users can seek answers to their questions 24/7 through the live support team.

Moreover, future IC Markets users should not be concerned about the legitimacy of this company. Not only the Australian broker is positioned in Sydney, but ASIC regulates the company – AFSL no. 335692. The Australian Securities and Investments Commission is the top-tier Australian regulator, which makes IC Markets a safe choice.

Markets

Forex

- 60 currency pairs

- Tight spreads from 0.0 pips

- Up to 1:500 leverage

- Liquidity

Indices

- 17 Indices to trade from across the globe

- Up to 1:200 leverage

- No commissions

- MetaTrader 4, MetaTrader 5 & cTrader

Commodities

- Over 19 commodities to trade

- Energy, agriculture as well as metals

- Spot and Futures CFDs

- Up to 1:500 leverage

Stocks

- 120+ stocks from ASX, Nasdaq & NYSE

- Dividends

- MetaTrader 5

Bonds

- Over 6 Bonds available to trade

- No commissions

- Up to 1:200 leverage

- Liquidity

Crypto

- Long or short

- Up to 1:5 leverage

- 10 of the most popular Cryptocurrencies

Futures

- 4 Global Futures available to trade

- No commissions

- Up to 1:200 leverage

- Liquidity

Automated Trading System

As you know, a VPS is what allows traders to run automated trading strategies. Moreover, the Virtual Private Server allows traders to trade 24 hours a day, 7 days a week. On top of that, this is the fastest possible connectivity to the IC Markets trading servers. By using a VPS, traders are ensured a trouble-free environment. Also, there won’t be a need for any additional computer hardware, back up internet, or power supply. The company recommends VPS providers co-located inside Equinix data centers with direct cross-connects to our trading servers in Equinix NY4.

Forex VPS

- VPS activation time: 5 minutes

- ForexVPS guarantees a 1 millisecond latency times to IC Markets NY4 servers

Beeks FX VPS

- IC Markets has in place fiber optic cross-connects directly to Beeks NY data center.

- Traders can enjoy ultra-low latency.

- Ping times from Beeks VPS to IC Markets live server is less than 0.6 milliseconds.

New York City Servers

- VPS plans start at $20/month.

- Low latency

- Great support

Account Types

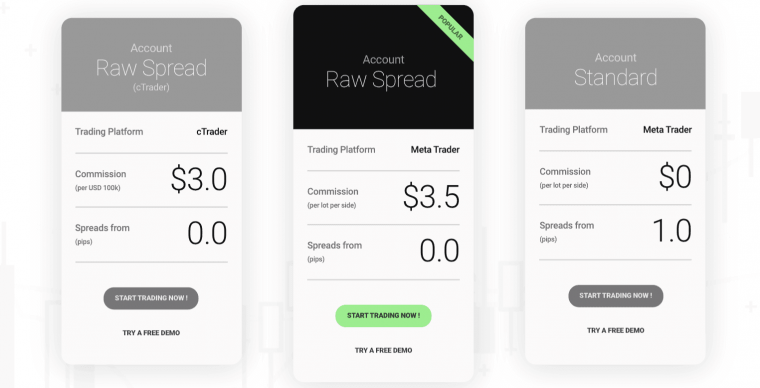

With IC Markets, traders have the opportunity to choose between two account types – Raw Spread and Standard.

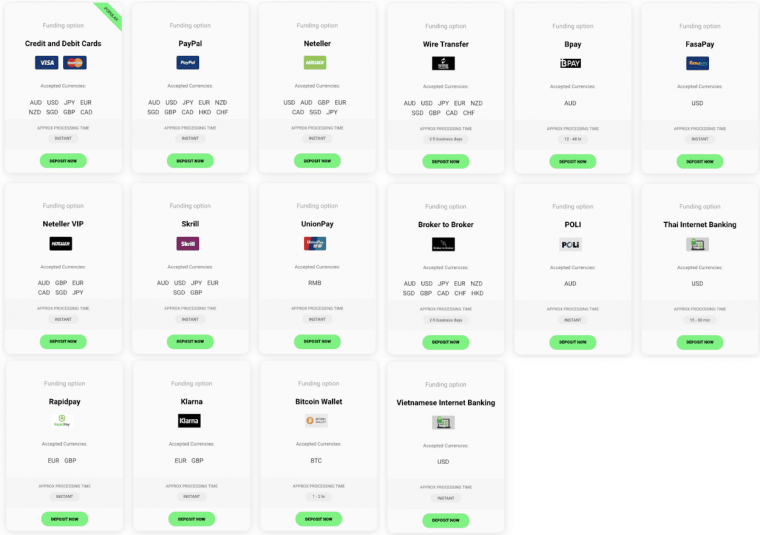

Account Funding

Currently, IC Markets offers over 15 flexible funding options in 10 different base currencies. Also, the range of methods for deposits is also wide. With IC Markets, traders can transfer their funds securely with 0% Commission.

Live Trading Account

- Fast account opening

- Instant funding

- Globally regulated

- Forex CFD Provider covering six asset classes and more than 200 products

Demo Trading Account

- Free to open

- All account types, platforms and products supported

Advantages of IC Markets

- Low fees

- Easy-to-open account

- Free deposit and withdrawal

- The most competitive spreads

- Wide range of tradeable instruments

- ASIC regulates IC Markets, which is one of the most respected regulatory bodies

- Free demo account

- 24/7 Chat with Specialist