Investing with Robinhood? Pros, Cons and More

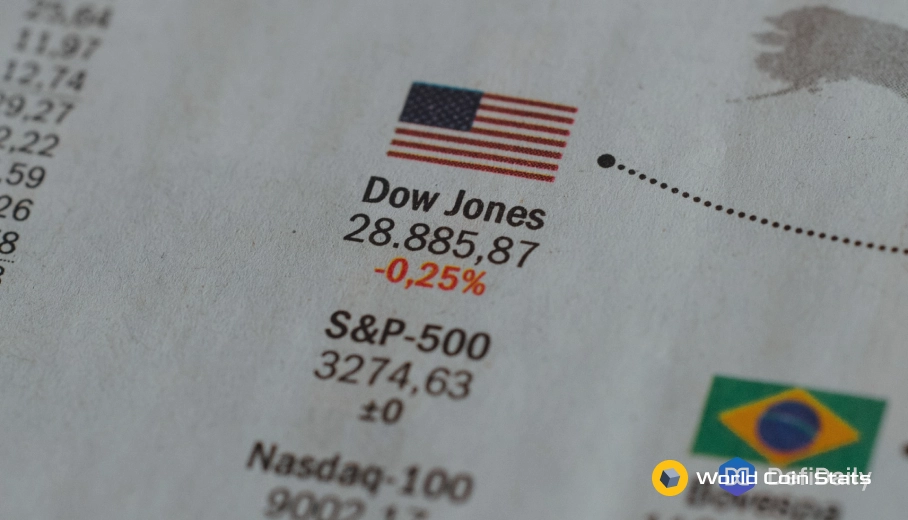

With time, we observe a rapid change in the stock market. In some phases, a rise in the tech stocks leaves all other stocks behind.

However, no one can predict the stock’s future. With a little change in policies and legal obligations, the stock face reflects a change in stock values. Also, the new faces in terms of startups prove to be a significant threat to existing ones.

In such a situation, traders search for a platform where they can have a better knowledge of the stock market. Beginners often choose Acorns and Robinhood as places where they can invest safely. In this matter, investing with Robinhood is probably the best choice investors have.

So, are you interested to learn more about advantages, disadvantages, and even other useful information about Robinhood? If your answer is yes, then you are in the right place.

Robinhood | Advantages

Before going into details, we need to note that understanding the electronic stocking platforms is crucial. Currently, there are only several electronic platforms, which provide you with the most useful information about stock values and trading.

Robinhood trading application is also one of them. It is one of the most popular platforms, helping traders in various ways. For example, the platform allows you to trade without paying crazy fees. And if you are an experienced investor, you will know why this is so important. With that being said, let’s take a look at some of the significant advantages of Robinhood.

Pros

- No minimum amount limit

- No commissions on stock trades

- Streamlined interface

The above three advantages of the platform make it clear that Robinhood provides excellent facilities to stock traders. Robinhood is a free-trading platform that is best for frequent stock traders. It helps the investors to know more about stock investment without taking any commission from them.

Usually, stock related platforms restrict investors to keep a specific amount in their account before they start trading. Robinhood eliminated such restrictions and allowed its users to enjoy stock trading without keeping any minimum amount in their account. The best thing about Robinhood is that it offers a streamlined interface to its users.

However, this feature of Robinhood can also be ranked as unfavorable, as it does not provide a notification facility like a typical online stockbroker. Further, the platform contains all the required features stock investors might need. Users must know how to use it effectively. For example, Robinhood supports stop limit, limit orders, market orders, and stop orders features.

Furthermore, the platform supports mobile software so that investors can know about stock prices anytime, and anywhere. Robinhood offers individual taxable and margin accounts to users. By becoming a member, users can easily and frequently interact with other investors. Also, another best thing about Robinhood is that it supports cryptocurrency.

Robinhood | Disadvantages

With a lot of positives, there always exists some negatives with every service. The same is the case with Robinhood. Though it provides excellent features to its users, still some features are missing.

Cons

- No mutual funds or bonds

- No retirement accounts

- Limited customer support

Robinhood does not support mutual funds or bonds. It does not have any retirement accounts, as well. The worst thing about Robinhood is that it offers limited customer support to the users, due to which many of the users remain confused and unable to use this app efficiently.

Penny Stocks on Robinhood

Investors have the chance to invest their money in penny stocks. Currently, some of the most popular penny stocks on Robinhood are Fitbit, Plug Power, Chesapeake Energy, Nio, and Groupon.

- Fitbit showed a high fluctuation in its stock prices during the last few months. However, people expect to see a rise in the future.

- PLUG is another available penny stock of Robinhood. This stock is focusing on fueling cell development and on improving its share values in the market.

- Chesapeake Energy (CHK) started falling to $1.74, but in June again regained its importance. It showed a bit rise to $1.95.

- NIO Stock showed a significant increase in its prices for a long time.

- Groupon (GRPN) hit the highest rate of $3.75 in June 2019. Traders expect it to cross $4 soon.

These penny stocks indeed show very rapid growth and fall. However, holding these stocks for a long time can bring high profits. You can see more details here.

Big Question

Some misconceptions about Robinhood accounts are that these accounts are FDIC Insured. FDIC stands for Federal Deposit Insurance Corporation, which protects the depositors on depositing the funds in insured accounts.

Moreover, FDIC covers checking and saving accounts. It also covers money market deposit accounts. It does not include any mutual funds, including bonds, stock, securities, or certificates.

Recently, the Robinhood spokesperson declared that all Robinhood accounts are only SIPC insured. Are you aware of the term SIPC? Here it becomes necessary to elaborate on the difference between FDIC and SIPC.

FDIC is a co-operation which protects checking and saving accounts. On the other hand, nonprofit Securities Investor Protection Corporation (SIPC) insures the brokerage firms. It protects investors from any unauthorized access or theft attack on their account.

Further, Robinhood accounts come in the category of checking and savings accounts, for which they need to get FDIC insured. Recently a spokesperson of Robinhood said that ‘the cash in Robinhood checking and savings accounts are protected by SIPS.’

This statement raised a lot of questions on Robinhood. Moreover, investors started going for other options, similar to Robinhood but which are insured. The primary issue of Robinhood was how the checking and saving account got insures with SIPC when it does not cover them?

SIPC took quick action against the statement of Robinhood Spokesperson, and the Head of SIPC said that ‘Robinhood spokesperson is misinterpreting the protections it provides.’

In return, the Robinhood Spokesperson said that ‘We invest customer cash in safe, high-quality assets such as U.S. treasuries.’ Does this mean they need to elaborate more? How are they using investors’ funds? What procedures do they follow for their security?

Bottom Line

Robinhood is no doubt a fantastic platform to trade with stocks. However, its security issues raised a lot of questions on its privacy policy and misinterpretation of terms. Now people are further waiting to listen from Robinhood about the reality behind the wrong statement.

Also, investors and traders want to know what methods exactly Robinhood follows to get insured? We will have to wait to see what Robinhood has to say.