Oil Price Rises and Remains Steady on High for 3 Months

TEXAS, United States – The price of oil rises on Friday, steadying at highs for three months. Despite the fall of the crude inventories of the United States or the US, the price increases, and it’s now on its fourth succeeding weekly gain.

Based on the new data, the United States crude inventories dropped more than anticipated. Despite the fall, the price of oils increased on Friday, December 27. The price is at its fourth week of consecutive gain, and it’s staying at highs for three months. Furthermore, the optimism and buoyant economic information from the trade agreement of China and the US powered a stock market assembly for the year-end.

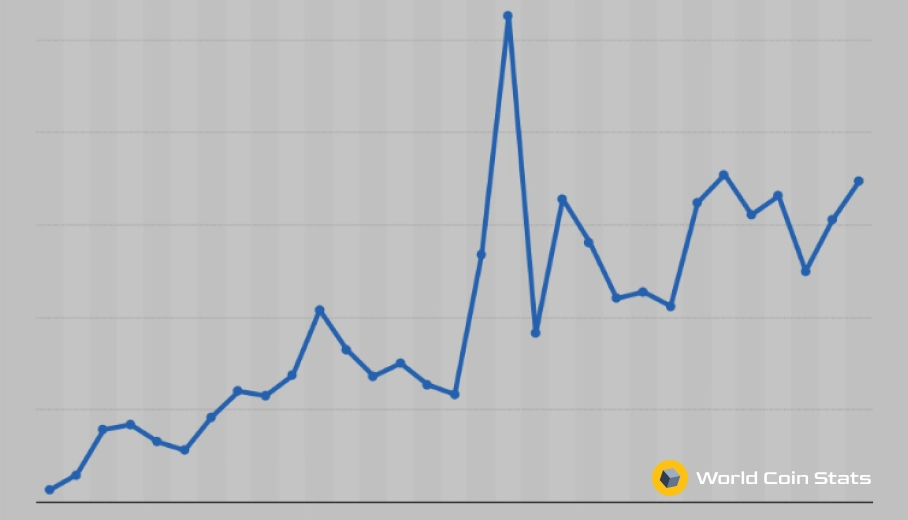

The price of Brent crude increased 24 cents to stay at $68.16 per barrel, which is the highest price since the middle week of September. The global benchmark has ascended closely 27% since the end of the year 2018.

The price of West Texas Intermediate increased 4 cents to settle down at $61.72 per barrel, and it’s also on its three-month high. The United States or US benchmark has climbed 36% this year.

The US crude stocks dropped 5.5 million barrels during the week up. It fell further to 441.4 million barrels, as per the Energy Information Administration. The drop exceeds the expectations of analysts, which is at 1.7 million barrels.

According to Josh Graves, a senior market strategist from RJO Futures located in Chicago, Inventories are upbeat nearly across the board. He also said that the year-end rally of the stock market also assisted in lifting oil prices as user sentiment sustained to develop.

Graves also mentioned that the rally is a Santa Clause assembly, wherein people tend to purchase more stuff that will ramblingly drive the oil price up.

There was an increase in the stock indexes of the US on Friday, wherein the S&P 500 index is near to logging its most excellent year since 1997. For the first time, the Nasdaq spanned the 9,000-point mark on Thursday, December 26.

As per Baker Hughes Co. BRK.N, an energy services firm, the energy firms of the US wasted eight functioning oil rigs, which is the first drop in three weeks. Manufacturers shadowed through on ideas to reduce spending.

According to the National Bureau of Statistics, the oil-market sentiment enhanced as new information displayed incomes as the industrial firms in China increased at the quickest pace in eight months in November.

In the US, the survey displayed on Thursday that consumers grasped a record, pounding the expectations of analysts, and lifting the stocks of the US to new highs.