Stock to Flow and the Value of Bitcoin

The stock to flow ratio is one of the more important ratios to understand for natural resource production. Bitcoin is obviously not a natural resource. However, the ratio is still important to understand because Bitcoin operates very similarly to natural resources.

This article will explain the stock to flow ratio, the importance of it, and compare the stock to flow ratio of Bitcoin to other natural resources.

What is the Stock to Flow ratio?

Basically, Stock to Flow measures the abundance and production of any resource. It is the total amount of said resource divided by the annual production of the resource.

This model is typically used for natural resources. It’s especially useful for precious metals such as gold and silver, but it is useful for all natural resources.

For instance, we can apply stock to flow to gold. Approximately 190,000 tons of gold are in reserves across the world – this is the stock. It’s the total amount of a natural resource available. Not the total amount that has yet to be produced (or mined in the case of metal).

Approximately 3,000 tons of gold are mined each year – this is the flow. It’s the total amount of a resource that enters the market in a given year.

With those two data points, we can determine the stock to flow of gold. Gold has a stock to flow ratio of 190,000/3,000 of approximately 63.

That is a high stock to flow ratio, which is great. In fact, gold has the highest stock to flow ratio of any precious metal.

Consumable goods will have a lower stock to flow ratio because they will have a higher flow to replace destroyed goods and a lower supply because they are consumable.

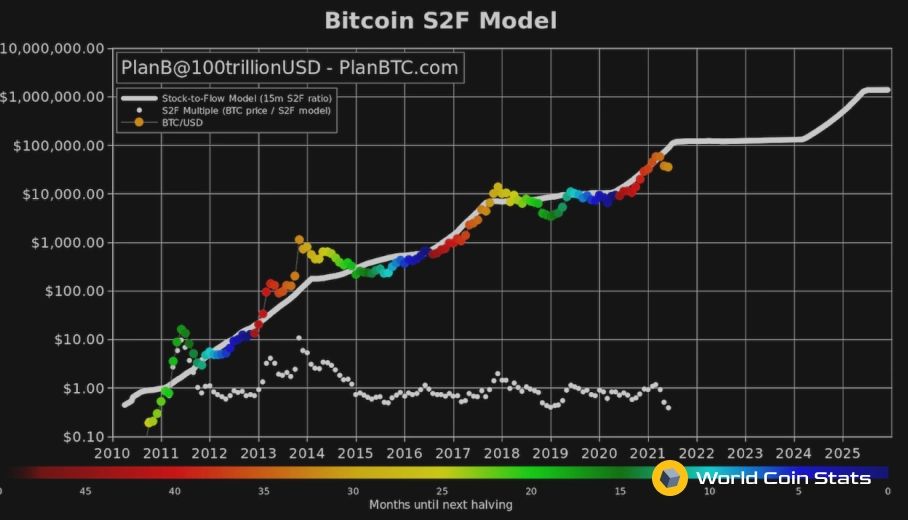

Stock to Flow and the Value of Bitcoin

We all know that Bitcoin is not a natural resource. However, it functions the same with an amount in reserve and a total supply that is yet to be produced/mined. The stack to flow ratio of Bitcoin can be stated in exact terms because all the information is recorded on the blockchain and shared publicly.

Other resources rely on estimates for the total amount in reserve and even the amount produced annually.

Anyway, Bitcoin has about 18 million total bitcoin in circulation and approximately 0.7 million bitcoin is produced each year. This gives Bitcoin a stock to flow ratio of approximately 25.

Bitcoin has measures in place to adjust the stock to flow ratio, though.The mining size of each block is halved after 210,000 blocks mined. This is done to reduce the amount of new supply entering the market. The stock to flow ratio should double after every halving, and it usually does double. You can learn more about Bitcoin value here.

Why Stock to Flow is a Good Model for Bitcoin

We briefly covered this in the previous section. However, it’s worth elaborating on for a better understanding of just how similar Bitcoin is to precious metals.

Bitcoin is Scarce

Bitcoin is a scarce resource just like gold and silver. Only a certain amount of Bitcoin can be mined each year, which is done to ensure that the resource stays scarce. And no large amount of Bitcoin can suddenly be mined.

High Barriers to Entry for Miners

Bitcoin mining has high barriers to entry. One cannot simply mine a sizable amount of bitcoin on their laptop. Doing so would be similar to someone panning for gold – they get some gold, but the total supply entering the market is not enough to impact the price.

These high barriers to entry on mining prevent the supply from increasing too rapidly, which does a good job of keeping the stock to flow ratio low.

Maximum Supply

Bitcoin, just like gold and silver, has a maximum supply. This prevents the flow from becoming too high because eventually Bitcoin will be depleted.

The advantage of Bitcoin is that the maximum is known to the public. With natural resources, the maximum supply is simply an estimate. This causes some uncertainty because a large amount of supply could enter the market and crash it.

The Shortfalls of Stock to Flow

Stock to flow is not a perfect model – it has some shortfalls. This section will cover those shortfalls.

Scarcity Increases Price

The biggest shortfall with stock to flow, in our opinion, is that it assumes the price is driven solely by scarcity.

This is obviously not true. Bitcoin could be a scarce resource, but if the public did not value it, then it would have no value. We know, this might sound crazy. How could the public not value Bitcoin?

This leads to the second shortfall of the stock to flow ratio.

Black Swan Events

Black Swan events are sudden events that randomly occur that lead to a sudden drop in price. Of course, these events are random by definition, so any model will struggle to account for them.

However, it’s important to note that Black Swan events do occur and to not be attached to the model. Bitcoin also seems especially susceptible to a Black Swan event due to its newness and open source nature.

Volatility

A resource with a high stock to flow ratio should have a low volatility. Gold and other precious metals have low volatility. Sure, the price changes some, but it’s overall a very stable resource.

As many of you already know, Bitcoin has very high volatility. We admit this volatility has gone down since Bitcoin’s inception. However, it’s undeniable that Bitcoin has high volatility. This is partly due to Bitcoin’s price being determined entirely by the free market and the low liquidity of Bitcoin.

With all that in mind, Bitcoin has a much higher volatility than it should considering it’s high stock to flow ratio.

What does this mean?

All this means is that stock to flow ratio is a good model for determining scarcity, but Bitcoin follows a different system than the model provided by stock to flow ratio.

Final Thoughts

All in all, the stock to flow ratio is a good metric for measuring the scarcity of natural resources. Bitcoin is not a natural resource, but it was designed with similar properties, so stock to flow ratio does work for it.

In fact, the stock to flow ratio can be measured very precisely with Bitcoin and other cryptocurrencies. Of course, stock to flow ratio does have some downsides just like any model.

However, it offers enough insight into Bitcoin to have some use. And that insight it does offer indicates that the price of Bitcoin should only go up barring any type of Black Swan event, which cannot be predicted by the stock to flow ratio.