The 3 Best Penny Stock Brokers of 2019

Do you want to know which are the best three penny stock brokers this year? Investing in penny stocks comes with many risks. However, regardless of the high risk, many experienced investors like to invest with penny stock.

Investing in penny stocks is a high-risk investment due to many factors. For example, limited filing, small capitalization, high bid spreads, lack of liquidity, and regulatory standards. However, this does not stop investors from buying penny stocks.

Moreover, the primary reason for this interest is the low price per stock. In other words, with a small budget, traders can invest in thousands of shares. In the stock market, several stock brokers offer penny stocks. Do you know the best penny stockers in the market? Then keep on reading.

Penny Stock Brokers

In the stock market, several brokers offer penny stocks. Some of them surcharge to the stocks that either bump up or trade below a certain level. On the other hand, some brokers provide free-trade services without any limit to trade.

If you want to know which are the most valued and preferred penny stock brokers, then you have come to the right place. Let’s not waste time at take a look at the three best penny stock brokers.

Robinhood

- Founded: April 18, 2013

- Headquarters location: Menlo Park, California, United States

- Founders: Baiju Bhatt, Vladimir Tenev

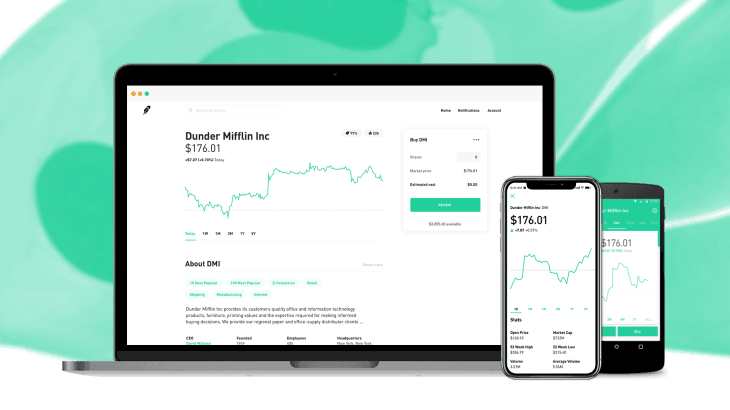

Robinhood is the most famous and preferred stockbroker. The company is helping traders know more about stock details and trade with penny stocks. Robinhood is a free-trading platform that is best for frequent stock traders.

Notably, this platform is beneficial for new traders. It helps the investors to know more about stock investment without taking any commission from them. The best thing about Robinhood is that it does not restrict the investors to keep a specific amount in their account.

Furthermore, it offers a streamlined interface to the users, through which the users can access the stock related information efficiently and effectively. Also, it supports stop limit, limit orders, market orders, and stop orders features. It also allows investors to compare the stocks side-by-side.

Though it provides excellent traits to its users, it does not support mutual funds, such as bonds. The worst thing about Robinhood is that it offers limited customer support to the users, due to which many of the users remain confused and unable to use this app efficiently. Some of the most popular penny stocks on Robinhood in 2019 are Fitbit, Plug Power, Chesapeake Energy, Nio, and Groupon.

Recently, Robinhood misinterpreted for being SIPC insured, after which a lot of questions left the worst impact on its reputation in the market. The Robinhood is no doubt a fantastic platform to trade with stocks, but its security issues raised a lot of questions on its privacy policy and misinterpretation of terms. Soon Robinhood will answer all questions of the users and might regain its market position.

Interactive Brokers

- Parent organization: Interactive Brokers Group

- Founder: Thomas Peterffy

- Founded: 1978

- Headquarters: Greenwich, Connecticut, United States

Interactive Brokers come in the list of mostly used brokers. It provides excellent facilities to its consumers and also does not apply any restriction of the Account Minimum. However, it does not support free-trading like Robinhood. Instead, it charges a commission of $0.005 per share.

However, it’s advanced features, and real-time margin calculations make it an ideal stock trading platform. With its competent services, Interactive brokers won the Best Overall Online Broker award. It was not the first award for Interactive Brokers.

It also has won Best for Low Costs, Best for International Trading, Best for Day Trading, and Best for Options Trading awards. When talking about why to use Interactive Brokers, it is one of the brokers which take low commission per trade.

Also, it supports the streaming of real-time data. The difference between Robinhood and Interactive Brokers rely on their assistance. Interactive Brokers provide AI-powered online aid to guide users in the best way. However, the worst thing about interactive brokers is that it streams only one device at a time.

TradeStation

- Parent organisation: Monex Group, Inc.

- CFO: Greg Vance

- Founded: 1982

- Headquarters: Plantation, Florida, United States

The third most recommended stockbroker is TradeStation. Though it is also one of the most preferring brokers, it restricts the user to have $500 in account minimum. Also, it charges $5/trade options.

However, it follows a unique strategy. The more you will trade, the less TradeStation will charge the fee. It follows this strategy to keep the users active in the stock market — all data in the TradeStation stream in real-time.

Another best thing about TradeStation is that it helps you to place, modify, and cancel trades via using keyboard shortcuts. TradeStation has also won Best for Day Trading and Best Overall Online Brokers awards.

Now the question that pops up in mind is, why does TradeStation charge a higher fee? Why does it restrict users from keeping a minimum of $500 in their account? The reason behind such restrictions is to allow the valued users and expert traders to trade via TradeStation.

Moreover, it only offers its services to investors with real interest. In return, it provides excellent charting analysis capability, flexible and customizable real-time market scanners, and a chance to reduce per-share fee with more trading. However, the worst part of the broker is that its multiple pricing plans are confusing.

Bottom Line

No matter which platform are you using to trade in the stock market, make sure you do your homework first. The stock market is risky. You can lose your entire money. So, the best way to prevent any loss is to analyze the stock market keenly before making any investment in the market. Any hasty decision may cost you your entire savings.

Also, keep one thing in mind. It is always recommended to do an in-depth analysis of the stock market. By finding a friendly and helpful broker, it should be easier to make the right decision when it comes to investing. And remember, invest carefully.