What Does FBS Stand For? | FBS Broker Review 2019

Can you and other investors trust FBS? Is this a legit company or just a scam designed to steal your money? With an experience of over ten years, most people would likely trust this company. However, despite the sizeable Asian presence of the company, some investors have their doubts when it comes to this broker.

The only question left then is: Should you trust this company?. Hopefully, this review will help you decide as we will share with you the essential information regarding this broker.

Contents

FBS Broker – Tradestone Ltd

Regulations: CySEC

Type: ECN, STP, No dealing desk

Leverage: 1:3000 (global brand) and 1:30 (EU brand)

Minimum deposit: $1 or € 10

Address: Limassol, Cyprus

FBS is an online Forex, CFD, and Crypto broker that was established in 2009. FBS Inc. is registered in the Marshall Islands. Currently, their head office is in Cyprus. Moreover, the company is operated by FBS Markets Inc. And as a Forex and CFD broker, FBS offers ECN and STP accounts.

If you go on their website now, you will see that FBS offers 75 investment options – 37 currency pairs, 4 metal instruments, 3 CFDs, and 32 stock instruments. Also, for the fans of MetaTrader platforms, FBS offers MetaTrader 4 and MetaTrader 5 trading platforms. Currently, MT4 and MT5 are available for Android, Windows, Apple iOs, Apple macOS, and Web Trader. For non-experienced traders in this field, this electronic trading platform was developed by MetaQuotes Softwares back in 2005.

MetaTrader 4 features include:

- Trade directly via a browser with WebTrader

- Compatibility with Windows, macOS, Linux

- Security enabled

- All types of trading orders

- One-Click Trading

- 24 graphical objects and 30 indicators for technical analysis

- 9 time-frames, from one minute to one month

- Real-time quotes

- Trading history and log

- Automated trading through Expert Advisors

MetaTrader 5 features include:

- Tools for technical and fundamental analysis.

- MetaTrader 5 can trade automatically by using trading robots and trading signals

- An advanced Market Depth feature

- One-Click Trading function and the Market Depth option

- The Stop Loss and Take Profit options

- 100 charts can be opened on the platform at the same time.

- 21 time-frames, from one-minute to one-month.

And some of the features of the apps are:

- Simple interface, user-friendly and easy to use

- Real-time market quotes

- Order management functions including history, SL and TP

- Account management

- Technical analysis using charts, technical indicators, and annotation tools

Perhaps, the essential question you have on your mind right now is if this company is legit. We have looked into FBS’s regulatory. Do you want to know the truth? Keep scrolling.

The Big Question: Is FBS Safe?

For what we know, the company is licensed in Belize for trading in securities services with the country’s IFSC – International Financial Services Commission. Moreover, the license number is IFSC/60/230/TS/18.

Before we continue, we want to add something else. According to independent sources, FBS lacks regulatory status in significant jurisdictions. Unfortunately, we couldn’t confirm this information, but we decided not to keep this information from you.

On the other hand, as you know, Tradestone Ltd is a Cypriot Investment Firm. As such, the Cyprus Securities and Exchange Commission (CySEC) regulates it. Moreover, the company operates based on license 331/17. With this license, investors and traders are guaranteed protection and security. Here’s what we know so far:

fbs.com is:

- Operated by FBS Markets Inc

- Registered in Belize

- Regulated by IFSC

fbs.eu is:

- Operated by Trade Stone Ltd

- Regulated by CySEC

And with two regulatory licenses, what does FBS protect their customers from?

Capital Reserves

Before a broker is allowed to apply for a license, they have to demonstrate capital reserves of:

- €750k in the case of CySec

- $100k in the case of the IFSC

Segregated Accounts

Both the CySec and IFSC mandate that brokers should maintain segregated client accounts away from the broker.

Asset Coverage and Leverage

Currently, on FBS, investors and traders have the opportunity to buy or sell the following:

- Forex – most of the standard G10 crosses, EM currencies

- Metals – Gold, Platinum, Silver, and Palladium

- Stocks – a number of them

- Cryptocurrencies – Bitcoin, Litecoin, DASH, and Ethereum

Moreover, these assets are traded in “lots.” Also, they vary according to your account type as well as the assets you trade. For example, the lot size with Forex pairs is 100,000 units.

Currently, the maximum leverage that FBS offers on Forex is up to 3,000:1. Also, your exact leverage would depend on two things — first, your account type. Second, the type of asset. And third, the size of the position. However, as you know, you will be trading with borrowed money. Or, in other words, you will be margin trading. So, you need to be extremely careful.

Account Types

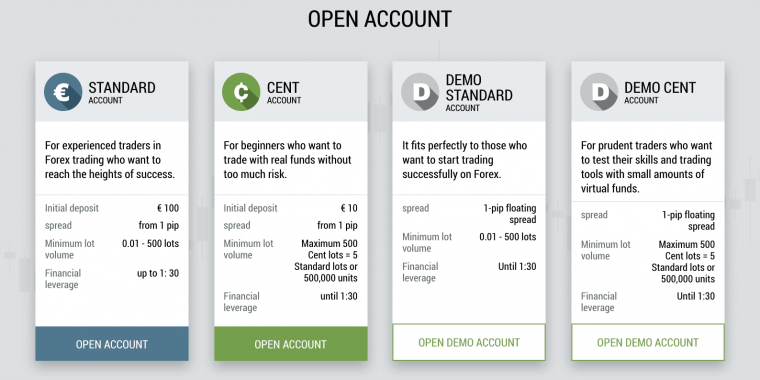

At the moment of writing, the EU brand offers a total of four accounts, two of which are demo accounts. For those who want to trade with real funds, FBS provides two types of real accounts. Moreover, the Cent account would require a deposit of only € 10. Meanwhile, the initial deposit for the Standard account is € 100. Also, the leverage is up to 1:30, and spread begins from 1 pip for both accounts.

With FBS, there is an opportunity for VIP accounts. However, you first need to fund your account with more than $10.000. Also, you have to have traded more than ten lots. Once you meet these criteria, you will qualify for a VIP account.

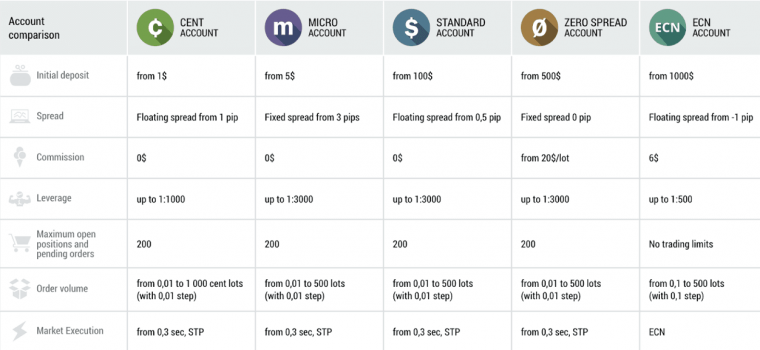

Meanwhile, the global brand offers five different account types. Of course, each account has special requirements and benefits.

So, FBS provides a wide range of accounts. By doing so, they allow their traders to choose the trading condition that best suits them. Here’s something interesting. For the past ten years, this company has grown substantially. Nowadays, they claim to operate over 12 million accounts in 190 different countries.

Deposit and Withdrawal Fees

Luckily for many investors and traders, FBS deposits are free. However, there is only one exception. When paying via SticPay, there is a 2.5% + $0.3 deposit commission.

Deposit Options: Credit Card, Neteller, PerfectMoney, Skrill, Wire Transfer

On the other hand, FBS does charge for withdrawals. Although the withdrawal fees are relatively low, they do depend on the method you choose.

- Visa Card: $1

- Neteller: 2% commission with a min of $1 and a max of $30

- SticPay: 2.5% + $0.3

- Skrill: 1% + $0.29

- Perfect Money: 0.5%

FBS Advantages

- CySEC and the IFSC regulate FBS

- The company offers 48 instruments

- FBS supports an extensive range of deposit methods

- Spreads from 0 pip and Leverage up to 1:30

- The company also offers MetaTrader 4 and MetaTrader 5 trading platforms

- Negative balance protection with a margin call and stop out levels

- A big choice of advanced tools and features to control your account

- Webinars, educational materials, daily analytics

- Used in 190 countries around the globe

- More than 20 international awards

- Fast deposit and withdrawal

- Low fees

- 24/7 customer support

FBS Disadvantages

- The company offers a limited range of instruments

- In the case of a market gap, profit can be limited to 300 pips

- FBS does not permit arbitrage

- Large spreads on crypto CFDs

- Limited crypto coverage

- No bank wires