What Happens When A Bond Becomes Due?

Typically, bonds generate income for investors in one of two ways. Either through periodic interest payments or by purchasing the bond at a discount. In rare cases, some bonds will generate income through a combination of the two.

Generally, bonds pay a fixed rate of interest at regular intervals. By doing so, bonds give investors the ability to predict their annual income with accuracy.

As you know, when you buy a bond, you are lending your money to a company. In other words, you are the borrower. On the other hand, the purchaser (issuer) may be an organization, government entity, or corporation.

Also, the credit rating of the issuer affects the interest rate of the bond. Typically, high credit rating issuers pay lower interest rates. Meanwhile, low credit rating issuers pay higher interest rates. By doing so, they compensate for the increased risk.

Moreover, the term of this agreement can vary from a few months or a year to 20-30 years. In short, you buy bonds in exchange for periodic payments with interest.

But What Happens When The Bond Becomes Due?

The maturity date is the date on which the bond is scheduled for redemption. Meanwhile, the maturity period is fewer than 30 years. So, on the maturity date, or the date the bond becomes dues, the purchaser (issuer) is expected to pay back the face value of the bond in full. In other words, when the bond becomes due, the purchaser (issuer) will have to pay you back, plus interest.

As we mentioned, bonds can generate income for investors through periodic interest payments or by purchasing the bond at a discount.

Interest Payments

Generally, the company that issues the bonds promises to pay the interest over the life of the bond as well as the principal when the bond becomes due. Of course, some investors (borrowers) might decide to sell the bond in the open market before it becomes due. Here’s an example.

A $100,000 bond with a 5% interest rate would pay the investor $5000 annually or $2500 semi-annually. Typically tax would be due on the interest each year. So, when the bond reaches the maturity date, the principal would be paid tax-free as a return of cash basis.

Purchasing at a Discount

The second way to earn money by buying a bond is to buy the bond at a discount, and you will get paid the face value of the bond. Here’s an example.

Say you have purchased a $100,000 for a discounted price of $90,000, and the term is ten years. On the maturity date, when the bond becomes due, you will receive $100,000. In other words, you will earn $10,000 from the difference.

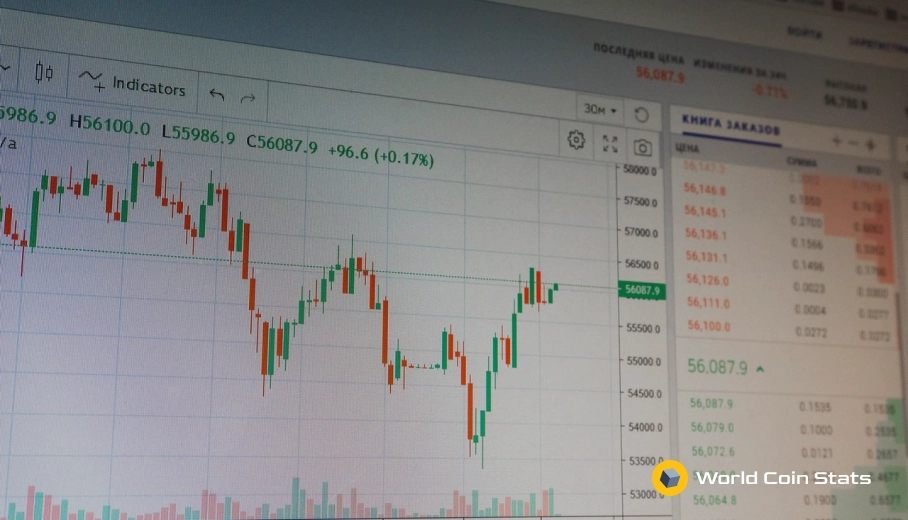

Can I lose Money With Bonds?

The answer is yes, bonds can lose money too. For instance, you can lose money if you decide to sell the bond before it becomes due for a price that is less than the one you paid. Further, you can also lose money if the purchaser (the issuer) defaults on their payments. It is good also to know the difference between bonds and stocks.

So, before you invest in bonds or any investment securities, make sure you conduct your own research when making a decision. Also, make sure you understand the risks of investing.