What is the Hang Seng Index | Hong Kong Stock Market

Do you want to get more information about the king index of the Hong Kong Stock Market? Well, that king index is the Hang Seng Index. Currently, it is one of the most preferred indexes.

Some of the stock members are dealing through the Hang Seng Index since 1969. Moreover, they find it to be the most fantastic investment of all time. However, despite it being so famous on the Hong Kong Stock Exchange, other investors lack any sufficient knowledge about this index. So, if you want to know more about this amazing index and its value in the Hong Kong Stock Market, keep on reading.

Hang Seng Index

NDEXHANGSENG: HSI

26,308.44 +600.51 (2.34%)

The Hang Seng Index is a capitalization-weighted index of the market. Nowadays, the largest companies in Hong Kong mostly prefer it due to its high value in the Stock market. In fact, 40 of the largest companies traded to date on the Hong Kong Exchange trust this index. Which, on the other hand, makes the HSI one of Asia’s biggest indices. And currently, the Hang Seng Bank subsidiary maintains the HSI in the Hong Kong Stock Market with the leading position.

Further, the HSI index aims to stand as the leader of the Hong Kong Stock Exchange. Presently this index is covering more than 63% of the total market capitalization. According to the estimates, one out of four members takes an interest in investing in HSI. It also falls into the sub-indexes, including properties, utilities, finance, and industry.

For the future, stock predictors are expecting a considerable rise in the value of the Hang Seng Index. That is why it is in the priority list of upcoming investors. Also, the HSI is the most quoted barometer for the Chinese Stock Market and the Hong Kong economy.

History of HSI

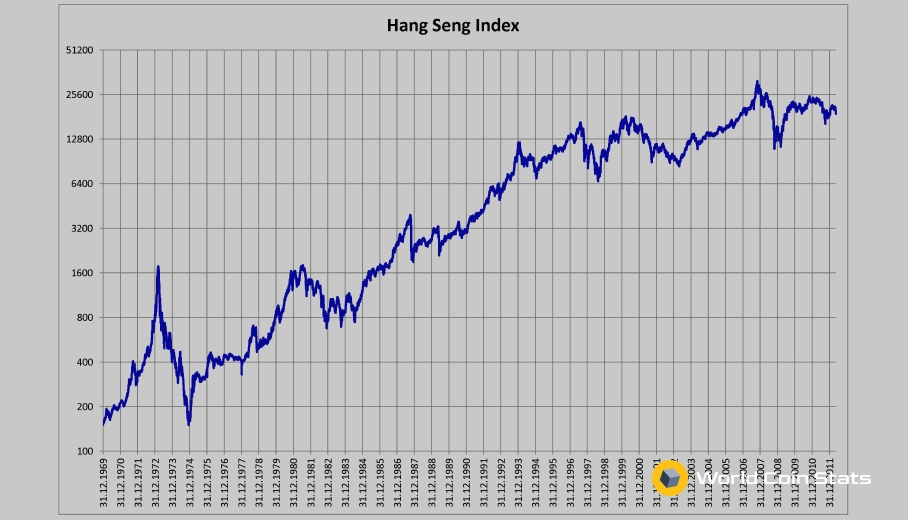

Hang Seng Index (HSI) was introduced in the Hong Kong Stock Market in the 1960s. Initially, its 100 points base was set equivalent to the total value of the stock on July 31, 1964. Moreover, the highest fall it faced was 58.61 points on August 31, 1967.

However, later, the index raised its value in the stock market and passed the 10,000 point milestone on December 10, 1993. With such marvelous performance in the stock market, it became an attraction for all investors. In fact, it gradually contributed to a considerable rise in its value, and in October 2007, the index touched 30,000 points.

Until now, the Hang Seng Index has achieved the highest points as 33,223.58 in 2018 and is expecting to record further rise in its value. It doesn’t mean that the Hang Seng Index had always shown a rise in its value. Instead, it also faced some greatest falls. It suffered a fall of 20,000 points on October 8, 2008, and closed at 15,431.73 points. This was 50% less than its actual value in stock at that time. Rise and fall are part of the stock market, and that is why no one can predict stock values with 100% accuracy.

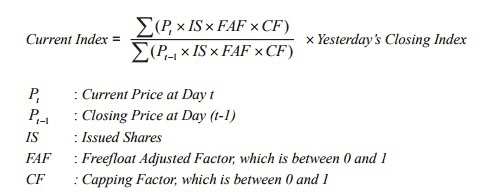

How to Calculate

Are you thinking of investing in the Hong Kong Stock market? Then, perhaps, you need to learn how to calculate the Hang Seng Index. Yes, despite the great rise and falls, the Hang Seng Index is leading the market. However, taking precautions is always better. For that, you should know how to calculate the current value of the Hang Seng Index. The following formula will help you to get the answer:

In the above formula, you can calculate the current value of the Hang Seng Index with the help of multiple parameters. Moreover, the very first parameter is P(t), which indicates the current price of the index at the Day time. The second parameter is P(t-1), which shows the closing price of the index on the previous day. Similarly, the third parameter is IS, which indicates the issued shares. Here you need to take the H-share portion only in case of H-share constituents.

Further, the calculations include a fourth parameter – FAF. It indicates a free-float-adjusted factor. Moreover, this value can be anything between 1 and 0 and is adjusted by the stock exchange quarterly. The final parameter is CF, which is a Capping Factor. It’s value also exists between 1 and 0 and is adjusted quarterly by the stock exchange of Hong Kong.

Recent Value of the Hang Seng Index

According to the records of 2018, the Hang Seng Index showed a fall in the stock market. It dropped more than 1.2%, which was a fall of 375 points. Also, the property stock of the Hang Seng Index, Sun Hung Kai properties, Hang Lund Properties, and Sino Land showed a decline of 1.4%, 1.7%, and 2.2%, respectively. However, this fall does not mean that the value of the Hang Seng Index is declining.

Furthermore, it is predicted that the index will rise with considerable points soon. Investment with the Hang Seng Index is always beneficial. Moreover, it will become more profitable as the interest rate will continue to grow.

Are you planning on investing in the stock market and enjoying long term profits? Make sure you broaden your knowledge of how the market works first. By doing so, you will be able to invest your money smarter.