How Should I Handle My 401k Investments During The COVID-19 Pandemic, Move to Bonds or Stay the Course?

Many people have many different saving options for their future. However, in light of the COVID-19 pandemic, you are probably wondering what you should do with your 401k.

As you have seen by the title, and your own thoughts, you are trying to decide if you should move the money away from your 401k, or if you should hold out.

The first thing that you should do is to read our article about losing your 401k in the market crashes. As you will see in that article holding all of your investments in stock shares can be difficult if the stock market crashes.

Should I Move My 401k?

Market values are plummeting, and the uncertainty is real. Unfortunately, that leaves us with more questions than the simple; “should I move my 401k?” question.

The first thing that you need to know is where you have money invested now. Knowing the type of fund that the money is invested in will significantly help your decision of what to do with it at the moment.

Funds to consider

For example, if you have all of your money in a conventional fund or conservative fund, you are likely to have more of a chance that the markets will recover. They always have, and we can bet that they always will.

If you invested it all into an aggressive fund, then things are a lot more uncertain. All risk levels between those have differing levels of recovery. However, looking at an aggressive fund, you may have had all of your money invested into a company that has already gone bust because of COVID-19.

Questions to Ask

Of course, this pandemic, and the markets surrounding it, has a lot of questions cropping up. However, the primary subject of; “should I move my 401k?” is not the root that you need to look at.

Firstly, you need to understand your personal situation. For example, ask yourself these things:

- How long do you have until you retire?

- How have your investments changed?

- Are they likely to recover?

Only then can you make a real decision on what you should do with your 401k. For example, if you have a long time until you retire, you can bet that it is enough time to recover. Unless that is, you have had an aggressive fund and already lost it all.

Is it Wise To Move Your 401k?

Let’s say that you have saved the maximum of $19,500 for the past ten years. That is a lot of money to see dwindle away in a pandemic. Even if you haven’t saved that much, anything you have saved is more than you want to see go.

A market stock crash is a sudden change of 10% from its high over 52 weeks. So, if you have lost 10% of your money on a crash, and you remove it to change investments, you are already 10% (or more) down.

While you may feel safer with that money in your savings account, the next question is, when do I put the money back into the market? To break even, you need to invest it back while it is still at a 10% loss. However, at that point, there was no point in taking it out.

If you put your money back into the 401k when you feel comfortable with it, you are likely to have still lost a lot of money. With the uncertainty of market stocks, you may put it back when they are back to a 2% loss. At that point, you have lost 8% of your money, and what if it crashes again? You will lose even more.

Wall Street Crash

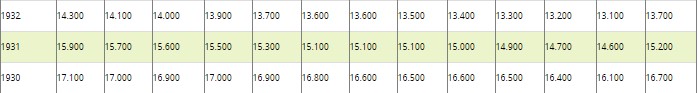

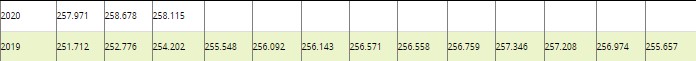

To have a better idea of the future, we need to look back into history. The most enormous crash was during the great depression of 1929-1932. If you look at the Historical Consumer Price Index data, you will see that, in the worst years (1931 and 1932), the average price dropped from 16.700 to 15.200 to 13.700, respectively.

The drops in the opening months of those years were an average of 1.35%. The initial drop after COVID-19 started in February 2020, and by March, the price had only dropped by 0.22%.

While this doesn’t prove the future, it does leave us in a right stance to predict it. Even if we see the same drops as with the Great Depression, we know that it took around 13 years for the average prices to recover. So, if you have >20 years left in your 401k, you can be pretty confident that it will improve, and quicker than the average 13 years of the Great Depression.

This isn’t The Great Depression!

I hear what you are saying, the circumstances surrounding the great depression are different from COVID-19. However, one thing that is not different is the stock markets.

The reality of the fact is; stock markets go up and down. They always have, and they always will.

What Should We Do?

Hopefully, by now, you are asking this question. What you need to do is understand your personal situation. Not rush into a decision that you will later regret.

First of all, you need to look at where you have your money. Take a look back at the historical data for that asset, and decide if it is likely to recover in the time that you have available to you. If it looks probable, then great, if not, make plans to restructure your funds, but only when the markets start to recover.

Secondly, if you have a company-sponsored plan, you can talk to them and ask them for their guidance. However, be wary of only using the companies information, as they may want you to keep the money in there as long as possible.

Finally, you need to look at what financial position you are in right now. Many experts will claim that you need between three and six months’ worth of essential expenditure in savings. If you are at risk of unemployment, consider taking some of your money out to help with that fund. If you are not at risk, then think carefully before moving it.

Conclusion

In conclusion, the most significant pieces of advice that I can give to you are that; when people panic, they make bad decisions. Try not to be one of those people; the markets will recover; they always have.

The last piece of advice that I would like to share with you is, during COVID-19, do not touch your face and do not touch your 401k, unless you absolutely have to. And if you do, be careful.