Beginners Guide to Investing in Index Funds 2019

Do you know what is considered to be one of the smart choices one can make to increase his wealth in 2019? People who search for different ways to improve their wealth often choose to invest in stocks, cryptocurrencies, or index funds.

Both experienced and inexperienced investors already know what stocks and cryptocurrencies are, but beginners might not know what index funds are and why they should consider investing in index funds in 2019?

In 2007, the American business magnate and investor, Warren Buffet, made a $1 million bet. He was sure that an S&P 500 index fund would generate higher returns than an actively managed hedge fund over ten years. Not only did Warren Buffet won that bet, but he also recommends index funds as a haven for savings for retirement.

So, keep on reading to learn everything you need to know about index funds.

What are Index Funds?

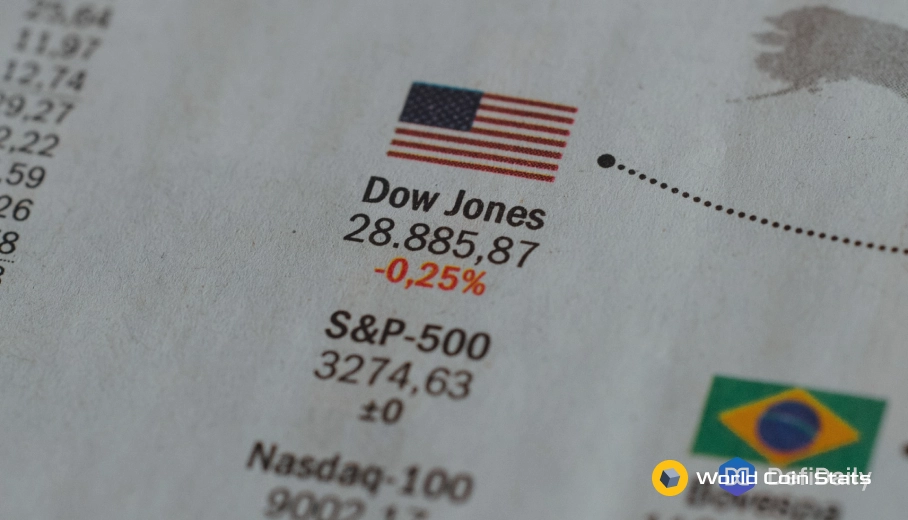

Index funds are a type of mutual fund that tracks the performance of a market index, such as the S&P 500 (Standard & Poor’s 500 Index). The S&P 500 is an index that represents approximately 500 of the largest US companies. Apple, Amazon, and Microsoft are among the represented companies.

Index funds are considered to be affordable, well-diversified, and ideal core portfolio holdings for retirement accounts as they can generate substantial returns over time. Also, an index fund is a portfolio of stocks or bonds that follows a passive investment strategy. This portfolio is designed to measure the value of a group of stocks over time.

And each stock is weighted, usually based on its market value, so larger companies’ stock prices affect the value of the index more than smaller companies’ stocks. After reading about the basics of index funds, you might want to learn more about why investing in index funds is a smart decision for both experienced and new investors. So, keep on reading.

Why Should You Consider Investing in Index Funds?

Index funds are a great investment choice for investors who want to double their current wealth to save money for retirement or to save their family from financial hardship in the future. Due to the many advantages of index funds, they are preferred both by new and sophisticated investors.

For new investors without a lot of experience on the market, index funds are a great choice because they have a lot of advantages. One of them is that with index funds, investors can track the entire market as a whole because index funds are groups of investments.

Tracking one specific stock is not difficult, but if investors want to invest in more than one stock, then this might be time-consuming. Index funds are easy to manage, and even inexperienced investors who are new in the investing business and tend to make rash decisions can successfully increase their initial investment.

So, let’s take a look at what index funds are why they are a preferred core portfolio holdings by investors.

Index funds:

- Are a type of mutual funds and have lower mutual fund expense ratios than other mutual funds

- Have low portfolio turnover or high passivity

- Are well-diversified

- Have low operation expenses

- Are a type of mutual funds with a portfolio constructed to match or track the components of a financial market index

- Have lower costs and fees than actively managed funds

- Follow a passive strategy

Index funds are well diversified, and thus they have a low-risk percentage. They also have lower mutual fund expense ratios than other mutual funds. For young investors that are trying to build an extensive portfolio, this can add up to real money over time.

Let’s not forget to mention that index funds, in some investment categories, have outperformed a majority of active funds. Some experts believe that a portfolio holding only index funds has higher chances than a portfolio that contains actively managed funds.

With this being said, it’s time to see which are the best three index funds to consider for future investments. Let’s take a look.

Which Are The Best 3 Index Funds To Invest In?

Nearly every financial market nowadays has an index and an index fund. In the U.S, the most popular index funds track the S&P 500. But several other indexes are widely used as well The best three index funds for 2019, that have low expense ratios and are highly diversified, are:

FUSEX: The Fidelity Spartan 500 Index Fund

- One of the most popular funds

- This index fund allocates nearly 80% of the fund to S&P 500

- The Fidelity Spartan 500 index fund has a minimum investment requirement of $2,500

SWPPX: The Schwab S&P 500 Index Fund and The SchwabTotal Stock Market Index Fund

- The S&P 500 Index fund invests in 500 of the largest stocks that allocate 80% of the stock market’s value.

- The Total Stock Market Index Fund invests in nearly 2,500 companies that make up all of the market’s value.

- Expense ratio is 0.09% for both.

- Annual fee of $3 for every $10,000.

VTSAX: The Vanguard Total Stock Market Index Fund

- This index fund has low costs, broad diversification, and is tax efficient.

- Expense ratio is 0.14%.

- Microsoft Crop., Apple Inc., Amazong.com Inc., and Facebook Inc. are among the most significant represented companies.

Here are other prominent index funds investment ideas to take into consideration:

- Russell 2000

- Wilshire 5000 Total Market Index

- MSCI EAFE

- Barclays Capital U.S. Aggregate Bond Index

- Nasdaq Composite

- Dow Jones Industrial Average (DJIA)

- Fidelity ZERO Large Cap Index

Bottom Line

As you saw, index funds are an excellent tool for investors to diversify their portfolios, and since they have massive potential for high returns with low risk, index funds are one of the most powerful tools.

Also, people who have more financial literacy and understanding of the market tend to make smarter decisions. That’s why it is inevitable to study the market. So, use the knowledge and experience you have as an investor, even if you are a beginner, and take advantage of the many benefits index funds have!