xDai, Honey and Uniswap: DEXes Outside Ethereum

2020 has been the year of the decentralized cryptocurrency exchange (DEX). This year has seen DEXs rise from a total market share of less than $1 billion USD to well over $14 billion USD.

To put it simply, 2020 has been a huge year for DEXs. The majority of the growth in DEX has been due to users staking their cryptocurrency. Staking is simply providing liquidity to the exchange by locking your cryptocurrency into the trading pool. Stakers receive a share of the mining fees in exchange for providing this liquidity.

Anyway, this article will discuss the most popular DEX:

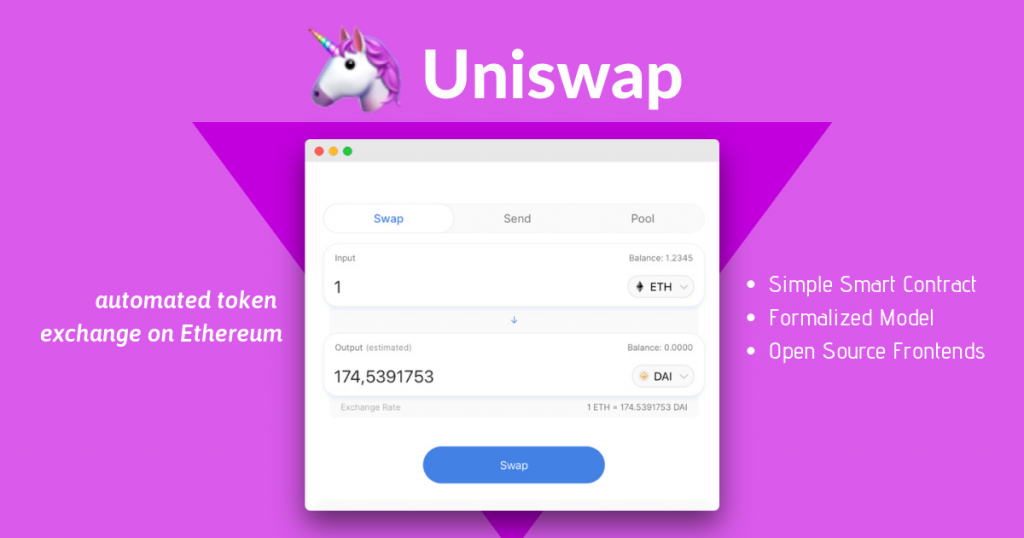

Uniswap.

Additionally, we will discuss a cryptocurrency and exchange that operate outside the Ethereum blockchain.

Uniswap: The Top DEX

First, Uniswap is the undisputed top decentralized cryptocurrency exchange. This is evident by the 24 hour trading volume on the exchange – $300 million USD. The next closest DEX is 0x Protocol with a 24 hour trading volume of $98 million USD.

Uniswap also has about 35% of the total trading volume on all decentralized exchanges.

It’s an extremely popular exchange.

What is Uniswap?

As mentioned previously, Uniswap is the most popular decentralized cryptocurrency exchange (DEX). The protocol is built on the Ethereum blockchain and has the ability to swap any ERC-20 for Ethereum.

That’s right, any ERC-20 token can be listed on Uniswap. All one has to do is write a smart contract for the token and deposit an equal dollar amount of Ether and the ERC-20 token on the exchange.

Uniswap will handle the buying and selling of the token on the exchange.

When was Uniswap launched?

Uniswap was launched in November 2018. It received a $100,000 grant from the Ethereum Foundation, which made it much more trustworthy than other decentralized cryptocurrency exchanges (DEX) available at the time.

Who founded Uniswap?

Hayden Adams founded Uniswap. He’s a newcomer to the cryptocurrency industry, but Uniswap is decentralized, so he’s not as important at this stage of the project.

What makes Uniswap different from other decentralized cryptocurrency exchanges?

The main difference between Uniswap and other decentralized cryptocurrency exchanges is that Uniswap has a unique way of determining the price of a cryptocurrency. Instead of having an order book like all centralized exchanges and many decentralized exchanges, Uniswap determines the price of a cryptocurrency by something called the “Constant Product Market Maker Model.”

Basically, this model can be explained by:

x * y = c

C is a constant. X is ETH and y is the ERC-20 token denominated in total fiat value, so if a user buys ETH with the ERC-20 token in the trading pair, then the price of ETH increases. This price increase will cause users to sell ETH to the trading pair for the ERC-20 token, which will drop the price of ETH and raise the price of the ERC-20.

This cycle repeats endlessly.

This system is basic, decentralized, and does a great job at providing buyers and sellers with what they want – cryptocurrency.

The only real problem with this model is that trades are required for prices to change. Fortunately, Uniswap has enough volume that there are always trades occurring, especially because arbitrage opportunities with other exchanges become available if the price does not change quickly enough.

The other unique part about Uniswap is that any cryptocurrency can be listed on the exchange. As mentioned previously, all one has to do is write a smart contract and fund an equal amount of ETH and any ERC-20 token on the exchange.

Uniswap has 1427 coins available for purchase at the time of writing.

Is Uniswap safe?

Yes, Uniswap itself is safe. It’s simply a protocol – there is no centralized authority governing it. However, it does have many scams that involve users pumping a junk coin, but those scams simply use Uniswap as a platform.

If you do not fall for a Uniswap pump and dump scam, then you will be perfectly safe using Uniswap.

Is Bitcoin available on Uniswap?

Bitcoin is not available on Uniswap – there is not much of a bridge between Bitcoin and Ethereum.

Fortunately, there is a solution to this problem.

Wrapped Bitcoin (WBTC)

Wrapped Bitcoin is an ERC-20 token that is 1:1 backed by Bitcoin. WBTC allows users to use Bitcoin on the DeFi ecosystem. Basically, Wrapped Bitcoin is a stablecoin that is backed by Bitcoin rather than fiat currency.

The one difference between Wrapped Bitcoin and other stablecoins is that Wrapped Bitcoin is very public with its financials. It is, in fact, backed 1:1 by Bitcoin as anyone can see by visiting the BitGo trust.

If you want to exchange your Wrapped Bitcoin for Bitcoin, then that’s as easy as taking it to an exchange to sell it for Bitcoin. Remember, Wrapped Bitcoin operates the same as a fiat stablecoin like Tether.

The Problems with Uniswap

Uniswap is a great decentralized exchange. However, it does have a few problems. This section will explain some of the problems with Uniswap.

It’s on the Ethereum blockchain

A major problem with Uniswap is that it’s on the Ethereum blockchain. As many of you already know, the Ethereum blockchain has some problems with blockchain bloat that causes slow transaction speeds and higher fees.

This has not been too big of a problem for Uniswap, but it could pose an issue at some point in the future. This issue may become even more apparent when sharding is released on Ethereum 2.0.

Sharding will mean no more synchronous communication, which could result in some problems for time sensitive swaps on Uniswap.

It’s open to manipulation

The other problem with Uniswap, and a major problem, is that the basic formula used to determine the prices of coins in a price pool is extremely open to price manipulation by users with a large amount of money (whales).

All it takes is a whale buying or selling a large amount of Ether or the ERC-20 token for the price to swing wildly, which can cause liquidity drops and other problems.

Another issue with Uniswap is frontrunning. In short, the “order book” is publicly available, which allows savvy users to jump the queue by sending a transaction with more gas. This will cause their transaction to hit the mempool first, it will get mined, and then cause a worse transaction for the order that the frontrunner skipped.

There is a solution to this problem, but it has not been implemented by Uniswap at the moment. Fortunately, the loss from frontrunning is usually within the acceptable slippage range, so it’s not too big of a concern for most buyers.

xDAI: An Emerging Stablecoin

xDAI is an emerging stablecoin that exists on a sidechain of the Ethereum blockchain. This means it does not rely on the Ethereum network for transactions, so it’s a little faster and much cheaper.

You may have noticed by the name – xDAI is a derivative of DAI. DAI, for those that don’t know, is an ERC-20 that is backed 1:1 by the US Dollar.

Of course, this raises an interesting question, what is the purpose of xDAI if DAI is a stablecoin?

THe next section will answer that question.

The Differences Between xDAI and DAI

There are a few key differences between xDAI and DAI. The main difference being that xDAI has significantly lower transaction fees than DAI and xDAI is much faster.

Lower Transaction Fees

The cost of an xDAI transaction is $0.00002 USD per transaction, which is essentially free. A transaction on DAI will cost about $0.15 per transaction.

Much Faster Than DAI

The other difference between DAI and xDAI is that xDAI is much faster than DAI. The average transaction on xDAI will take about 5 seconds while the average transaction on DAI will take about 5 minutes.

That’s a huge difference. However, the difference between 5 seconds and 5 minutes is not significant for the average user.

Purchasing xDAI

The one downside with xDAI is that it’s difficult to purchase. You cannot simply sign onto Coinbase and purchase xDAI with USD like you can with DAI.

xDAI also is not an ERC-20 token, so it’s not available to purchase on most decentralized exchanges.

The process is more complicated. Here is one method to purchase xDAI:

- Purchase DAI on Coinbase Pro. You can use fiat or Bitcoin to do this.

- Transfer the DAI to Dex Wallet.

- Exchange the DAI for xDAI in the wallet.

When was xDAI launched?

xDAI was launched in October 2018.

Is xDAI a scam?

No. xDAI is not a scam.

Many cryptocurrency experts believed it was a scam at the beginning, but it has proved itself legitimate. It also received a retweet from Ethereum founder Vitalik Buterin.

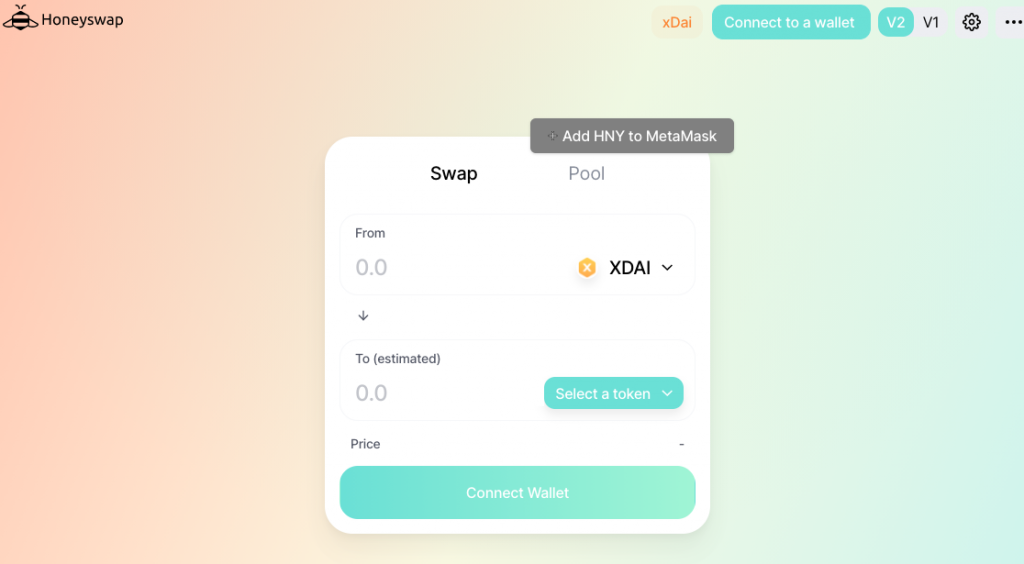

Honeyswap: An xDAI Decentralized Exchange

Remember how we mentioned that not many decentralized exchanges have an xDAI trading pair.

Well, there is one decentralized exchange that has an xDAI trading pair – HoneySwap.

HoneySwap is very similar to Uniswap. In fact, it’s a 1:1 clone of Uniswap adapted to the xDAI network.

The Positives About Honeyswap

Honeyswap has a lot of good things going for it despite its relatively small size and newness as a decentralized exchange. This section will cover some of the positives about Honeyswap.

Low Fees

Everyone that uses Uniswap is familiar with the high gas problem that Ethereum has at the moment. The transaction fees can range from $0.15 to over $50 during peak hours.

It’s one of the huge downsides of using Uniswap.

Honeyswap solved that problem because it’s on the xDAI sidechain. The transaction fees are insanely low at fractions of a cent. $0.0003 USD is a common transaction fee that you will see on

Fast Transactions

The other benefit of Honeyswap is that it has much faster transactions than Uniswap or other Ethereum based decentralized exchanges.

It’s extremely convenient to have fast transactions if you are attempting to quickly trade a pool. Now, this advantage isn’t nearly as noticeable because the speed on Uniswap is usually pretty fast, but it does occur from time to time that transactions will take forever to go through the network.

The Downsides with Honeyswap

First, we love Honeyswap. It’s a decentralized exchange that does not exist on the main Ethereum platform. Unfortunately, it does have some problems.

Fortunately, many of these problems are simply because Honeyswap is pretty new. But some of the problems are because it’s a little harder to use than a decentralized exchange that operates on the Ethereum blockchain.

Low Liquidity

The first problem with Honeyswap is that it has very low liquidity. This is somewhat expected because it does not have many users.

Of course, this is a chicken or the egg type of problem. Users don’t use Honeyswap because it has low liquidity, but it has low liquidity because no one uses Honeyswap.

On the bright side, this problem can easily be solved by offering liquidity mining rewards.

It’s Difficult to Use

A major problem with Honeyswap, and why it will likely not take off to the extent Uniswap has, is that it’s difficult for the average user to figure out.

In fact, this applies to most decentralized exchanges. Even if they have an easy to understand interface, it can still be difficult to understand how the APY and liquidity mining works.

Does Honey (HONEY) have a chance to moon?

Honey is the governance token for Honeyswap – it has a total supply of 26,000 coins and a market cap of $7,000,000.

It might be a worthwhile gamble as a moonshot, but we would not recommend putting too much money into it. HONEY could turn into Compound (COMP) if Honeyswap begins to take market share from Uniswap.

Final Thoughts

That covers everything you need to know about decentralized exchanges and the existence of exchanges off of the main Ethereum blockchain.

These exchanges, and cryptocurrency in the case of xDAI, are nice because they avoid one of the major problems with Ethereum based decentralized exchanges – high gas.

Seriously, the transaction fees on the Ethereum blockchain can wipe out small profits. And the gas fees increase when you need to make a transaction the most.

With that in mind, xDAI and Honeyswap are two projects that you want to keep your eye on in the DeFi and decentralized exchange industry. The fees are just so low that it would not make sense to use Uniswap if the fees stay this low with higher liquidity.